Clower’s DDH and Feedback

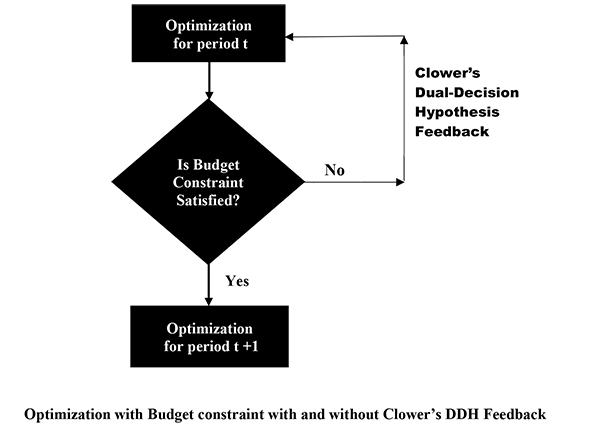

For Clower, the primary concern in any optimization is to question whether the budget constraint is satisfied or not. In case the first optimization is not satisfied, a feedback is required so that realized income inputs are applied in a new optimization. Only then one is allowed to proceed to the next step. This dual-step process can be best described by the following flowchart:

As Leijonhufvud (1968) wisely observed, “when the economic system fails to behave in the manner of the Classical model, it is not due simply to the absence of the feedback mechanisms assumed by the Classics.” Almost 20 years later, Hall's no feedback approach is an example of how mainstream economists failed to learn or understand the implications of Clower's DDH!

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Google Gemini take on Clower's DDH and Wu's consumption theory:

Clower dual decision hypothesis and wu consumption theory

This is the theoretical "engine room" of Cheng K. Wu’s work. To understand his consumption theory, you must understand the specific disequilibrium mechanism he borrows from Robert Clower (1965).

Wu’s entire contribution is effectively operationalizing Clower’s "Dual-Decision Hypothesis" (DDH) into a working mathematical model for consumption.

Here is the breakdown of the concept and how Wu uses it.

1. The Foundation: Clower's "Dual-Decision"

Robert Clower challenged the standard idea that markets always clear (General Equilibrium). He argued that in the real world, people face quantity constraints (e.g., unemployment) that force them to make decisions twice.

- Round 1: Notional Demand (The "Plan")

- This is what you want to buy based on prices and your expected income.

- Example: "At my current wage of $50/hr, I plan to buy a new car and save 10%."

- Standard Economics (Hall/Friedman) assumes you always stay in this round. They assume you can borrow/save perfectly to smooth over any bumps.

- The Constraint (The "Shock")

- Reality hits. You cannot sell as much labor as you wanted (unemployment) or your income grows slower than expected.

-

- Result: Your Realized Income < Notional Income.

- Round 2: Effective Demand (The "Dual Decision")

- Because your budget constraint is violated, you must scrap your original plan and make a second decision based on the cash you actually have.

- Example: "I didn't get the overtime I expected. I can't buy the car. I must cut my savings immediately."

2. Wu's Application: The "Feedback Optimization"

Wu argues that standard consumption theories (like the Permanent Income Hypothesis) fail because they mathematically assume the consumer never leaves "Round 1." They assume the budget constraint is always satisfied over the lifetime.

Wu applies Clower’s DDH to prove that Savings (S) is the variable that absorbs the shock between Round 1 and Round 2.

The Wu-Clower Mechanism

- The Plan (Expectation): The consumer sets a consumption path based on expected Income Growth (gYe).

- The Reality (Data): Time passes. The consumer observes their Realized Income Growth (gY).

- The Check:

- If gY≈gYe: The plan holds. (Equilibrium).

- If gY<gYe: Budget Constraint Violated.

- The Feedback (Correction): The consumer enters "Round 2." They effectively "re-optimize" their entire life plan.

-

- The Result: This re-optimization causes a sharp, deterministic change in savings.

- Equation: ΔSt+1=f(Yt+1−Yt)

3. Visualizing the Difference

I have constructed a logic flow to visualize how the Dual-Decision path differs from the Standard path.

- Standard Path (Top): The consumer ignores the bump in the road (Income Shock) because they focus on the long-term horizon. They borrow to smooth consumption.

- Clower-Wu Path (Bottom): The bump in the road acts as a Gate. If the shock is negative, the gate closes (Constraint). The consumer is forced into a feedback loop to "Recalculate" their savings before they can consume.

4. Why This Matters (The "New Result")

The connection to Clower is why Wu claims his theory is a "General Theory" (Disequilibrium) rather than a "Special Case" (Equilibrium).

| Concept | Standard Theory (Hall) | Wu’s Theory (Clower-Based) |

| Constraint | Lifetime Budget (Always satisfied) | Cash-in-Advance (Frequently violated) |

| Reaction | Smooth over shocks (Borrowing) | React to shocks (Feedback) |

| Savings | A passive residual | The active adjustment mechanism |

| Math | One single optimization at t=0 | Continuous re-optimization at every t |

Summary

Cheng K. Wu uses Clower’s Dual-Decision Hypothesis to break the "Random Walk." He argues that because consumers are constantly hitting "constraints" (failed growth expectations), they are constantly in "Round 2" of Clower’s decision process. This constant state of "re-optimization" implies that savings behavior is driven by the feedback from income growth, not by a fixed lifetime plan.

_________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Clower, R. W. (1965), "The Keynesian Counterrevolution: A Theoretical Appraisal," in The Theory of Interest Rates, ed. F.H. Hahn and F.P.R. Brechling, Macmillan, pp. 103-25.

Leijonhufvud, A. (1968), On Keynesian Economics and the Economics of Keynes: A Study in Monetary Theory, Oxford University Press.

Wu, Cheng (2017): "Does Clower’s Dual-Decision Hypothesis lead to the change in saving conclusion in Keynes’s General Theory?" https://mpra.ub.uni-muenchen.de/82840/

https://journals.econsciences.com/index.php/JEL/article/view/1497

Wu, Cheng (2018): "Clower’s Dual-Decision Hypothesis is economics". https://mpra.ub.uni-muenchen.de/84013/

https://journals.econsciences.com/index.php/TER/article/view/1611

Home