Hall's Approach

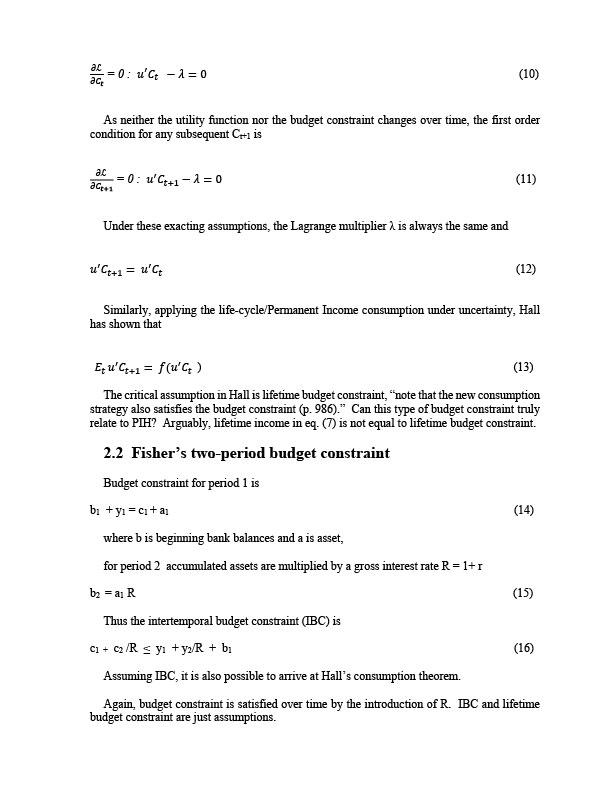

In recent economic theory, consumption optimization is given by an utility subject to a budget constraint (financial assets + labor income less of consumption). For whatever reason, Hall (1978) assumed that budget constraint ALWAYS holds. That is, we never ever consume more than what we have as financial assets and labor income. Thus, in Hall's consumption theory, optimal consumption for any period of time is only dependent on its previous time consumption, i.e., consumption is independent of income. In practice, if trade imbalance causes unemployment and lowers labor wages, i.e., slow labor income growth, trade has no effect on consumption or saving!

If IBC and lifetime budget constraint are just assumptions, what if they were violated in practice?

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Google Gemini on Hall's consumption, theory and evidence:

Hall's Consumption Theory: The Random Walk Hypothesis

Robert Hall's 1978 paper, "Stochastic Implications of the Life Cycle-Permanent Income Hypothesis," is one of the most influential works in modern macroeconomics. It formalized the Permanent Income Hypothesis (PIH) under the assumption of Rational Expectations, leading to the startling conclusion known as the Consumption Random Walk Hypothesis.

1. The Theory: A Consumption Random Walk

The theory's conclusion is straightforward: Consumption follows a random walk.

A. Core Principles

- Rational Expectations: Consumers are not fooled; they use all available information (past and present) to form the best possible forecast of their future income.

- Permanent Income Hypothesis (PIH): Consumers smooth their consumption over their entire lifetime, aiming to keep it stable even if their current income fluctuates wildly (e.g., they borrow when income is low and save when income is high).

- The Euler Equation: This equation describes the optimal consumption path over time. Hall showed that under PIH and rational expectations, the only factor that should change consumption from one period to the next is new, unanticipated information (surprise news).

B. The Random Walk

Because consumers have already factored all predictable income changes (e.g., a known pay raise, an expected retirement date) into their consumption today, any change in consumption tomorrow must be due to a genuine surprise (an unexpected death, a sudden bonus, a global pandemic).

- Conclusion: Since surprises are, by definition, unpredictable, the change in consumption (ΔC) should be unpredictable (random). The best forecast for tomorrow's consumption (Ct+1) is simply today's consumption (Ct).

- ΔCt+1=Ct+1−Ct=ϵt+1

- Where ϵt+1 is a white-noise error term representing the unanticipated 'news.'

Practice: The Problem of "Excess Sensitivity"

- While Hall's theory is mathematically elegant and provides a powerful benchmark, real-world practice often rejects the Random Walk Hypothesis. Empirical studies consistently find that consumption is often "excessively sensitive" to income changes that are perfectly predictable.

A. Empirical Challenge: Excess Sensitivity

If the theory held, consumption should not rise when a worker receives a scheduled raise or a predictable tax refund. The worker should have already factored that income into their spending months or years earlier.

However, studies find that:

- Consumption jumps significantly when predictable increases in Social Security payments arrive.

- Household spending immediately increases when a predictable tax cut or rebate is distributed.

This "excess sensitivity" means that a significant portion of the population is not consuming according to the sophisticated intertemporal optimization model proposed by Hall.

B. Reasons for the Theory-Practice Gap

The failure of Hall's model in practice highlights real-world constraints on consumer behavior that the model abstracts away from:

|

Constraint |

Description |

Impact on Consumption |

|

Liquidity Constraints |

Many households cannot easily borrow against future expected income. For example, a young doctor expecting high future earnings cannot get a large loan today just for consumption. |

Forces consumption to track current income rather than permanent income, leading to sensitivity. |

|

Myopia/Irrationality |

Consumers may be near-sighted, focusing too much on immediate needs rather than lifetime optimization, or lack the computational power assumed by "rational expectations." |

They fail to smooth consumption optimally, resulting in immediate spending when current income rises. |

|

Precautionary Saving |

Consumers face unexpected future risks (illness, job loss) that are hard to insure against. |

This leads to higher-than-predicted saving and a less stable consumption path than the theory suggests, as consumers are constantly building up a buffer stock. |

In conclusion, Hall's theory remains the benchmark for how a perfectly rational consumer would behave in a perfect financial market. In practice, however, friction from liquidity constraints and deviations from pure rationality mean that consumption often reverts to the Keynesian relationship, remaining highly sensitive to current, predictable income flows.

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Hall, R. E. (1978), "Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence," Journal of Political Economy, pp. 971-87, October 1978. https://doi.org/10.1086/260724

Wu, Cheng (2018): "Clower’s Dual-Decision Hypothesis is economics". https://mpra.ub.uni-muenchen.de/84013/

https://journals.econsciences.com/index.php/TER/article/view/1611