Trade

Though proven wrong in data, for the past 50 years, there has been given great weight to Hall's consumption theoretical result. But because it does not consider income as a factor in consumption, economists were unable to study the effect of trade into personal savings or the change in personal saving, i.e., the link between trade deficit -> higher unemployment -> lower labor income -> excess consumption and lower saving. The direct result of Keynes-Clower-Wu's consumption theory is that change in saving is a function of diminishing changes in labor income (unemployment due to trade deficit) or its labor income growth. That is, unexpected losses of employment and labor income caused excess consumption, which lowered saving.

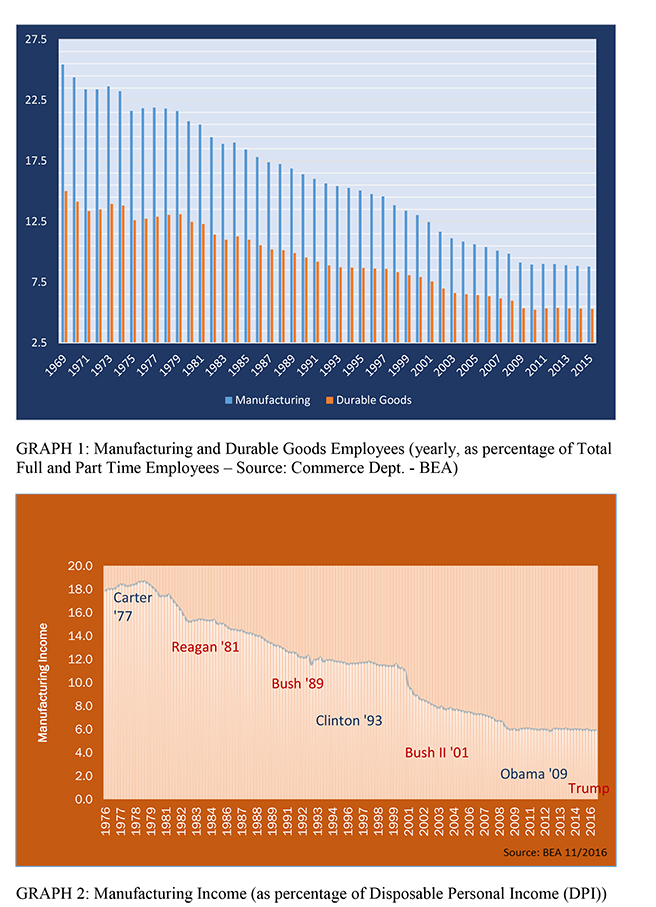

So here is the effect of trade imbalance on manufacturing jobs:

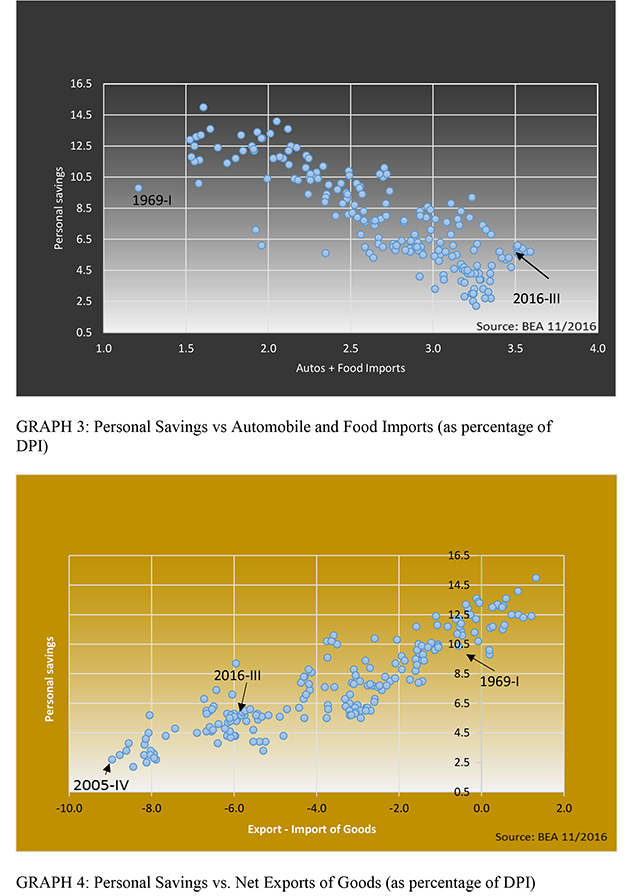

The chart below (originally made in early 1990s and updated recently) shows the relationship between trade and savings. Since imports of raw materials and other goods for production may benefit domestic manufacturing and jobs only imports of finished goods should be considered. That is, not all imports are bad for personal saving.

Contrary to Hall's consumption result, Keynes-Clower-Wu result provides the theoretical support to explain the data on the effects of trade on the U.S. economy, specially labor income and saving. One can extrapolate the same conclusion to other countries with significant trade imbalances (both positive and negative), which shows saving is in effect directely affected by the growth of their labor income. The upward and downward shifts in saving in other countries show there is no such thing as super saving societies! Otherwise, how could anyone explain the sudden decline in saving in countries such as Japan, Korea or China? In sum, one cannot "force" saving when employment is mostly in disequilibrium.

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

The following is the summary from Google Gemini on Cheng Wu and Trade:

Cheng K. Wu integrates International Trade into his consumption theory by identifying it as a primary driver of Labor Income Growth (gY).

In standard macroeconomics, trade deficits and savings are often treated as separate accounting identities (e.g., S−I=NX). Wu argues there is a causal behavioral link: trade deficits destroy labor income growth, which, according to his "New Result," mathematically forces a structural decline in the national savings rate.

Here is the breakdown of how Wu connects Consumption, Savings, and Trade.

1. The Transmission Mechanism

Wu's model is built on the equation that changes in savings are a function of income growth (ΔS=f(gY)). He maps trade into this equation through the following causal chain:

- Trade Deficit (Finished Goods): The economy imports finished goods that substitute domestic manufacturing.

- Labor Market Impact: This substitution reduces demand for domestic labor, leading to stagnation or negative growth in Labor Income (Y).

- The "Feedback" Trigger: Because income growth slows (gY drops), the consumer’s budget constraint is violated.

- Savings Reaction: The consumer cannot maintain their previous savings plan. To smooth consumption in the face of lost growth, they are forced to reduce savings.

- Result: A persistent trade deficit leads to a permanently lower national savings rate.

2. "Good" vs. "Bad" Imports

Wu distinguishes between types of trade, arguing they have opposite effects on the savings function:

- Imports of Raw Materials/Intermediate Goods: These are positive or neutral for savings because they support domestic production, employment, and thus labor income growth.

- Imports of Finished Goods: These are negative for savings because they replace domestic labor income.

Critique of Standard Theory: Standard theory (Ricardian comparative advantage) argues that displaced workers will move to "better" jobs, keeping total income growth stable. Wu argues that in reality (citing Clower's Dual-Decision Hypothesis), these workers often face extended unemployment or underemployment, causing a net drag on aggregate income growth, which drains the national savings pool.

3. Explaining the "Twin Deficits"

Economists often puzzle over why the U.S. has both a Budget Deficit and a Trade Deficit (Twin Deficits).

- Standard View: Low national savings cause the trade deficit (we borrow from abroad to consume).

- Wu’s View: The causality is reversed. The Trade Deficit causes Low Savings.

- By allowing the trade deficit to erode manufacturing income growth, the U.S. mathematically forced its households to save less (or dis-save) to maintain their standard of living.

4. Political Consequence (The "Rust Belt" Effect)

This trade mechanism is the economic foundation of his election predictions (specifically regarding the Rust Belt and Farm Belt).

- When trade policies (like NAFTA or China's entry into the WTO) caused a shock to labor/farm income growth in specific regions, it didn't just make people "poorer"; it forced a Savings Crisis.

- Voters in these regions depleted their savings to survive.

- The Re-Optimization: This loss of savings (utility) triggered the "re-optimization" described in his theory, leading them to vote against the incumbent party (e.g., voting for Trump in 2016).

Summary Table

|

Feature |

Standard Trade Theory |

Cheng K. Wu Trade Theory |

|

Causality |

Low Savings → Trade Deficit |

Trade Deficit → Low Savings |

|

Mechanism |

Capital Account / Investment-Savings Gap |

Labor Income Growth Shock |

|

Import Types |

All imports increase utility (variety/cost). |

Finished goods reduce savings; Raw materials help savings. |

|

Long Term |

Equilibrium (Factors of production reallocate). |

Disequilibrium (Permanent drag on savings & growth). |

Key Takeaway

For Wu, you cannot fix the U.S. savings rate without fixing the trade balance, because the trade balance dictates the income growth velocity that allows savings to exist in the first place.

_____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Wu, Cheng (2017): "Does Clower’s Dual-Decision Hypothesis lead to the change in saving conclusion in Keynes’s General Theory?" https://mpra.ub.uni-muenchen.de/82840/

https://journals.econsciences.com/index.php/JEL/article/view/1497